new hampshire sales tax on vehicles

Is New Hampshire A Tax-Friendly State For Retirees. 11 - What is the 2022 New Hampshire Sales Tax Rate.

Used Cars For Sale In Derry Nh Cars Com

State of New Hampshire Registration Fees.

. States with high tax. If you purchase a used Honda Civic for 10000 you will have to pay an. With the lowest average annual car ownership and maintenance costs cheap.

What kinds of fees and taxes am I looking at when I buy a vehicle in New Hampshire. State of NH fees vary based on vehicle type gross weight plate type and other factors. The New Hampshire cigarette tax of 178 is applied to every 20 cigarettes sold the size of an average pack of cigarettes.

What states have the highest sales tax on new cars. For details please call 603-227-4030 or visit the following. For multi-state businesses income is apportioned using a weighted sales factor of two and the payroll and property factors.

Heres how the additional costs associated. New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states. State of NH fees vary based on vehicle type gross weight plate type and other factors.

Here are a few other reasons why New Hampshire is the best state to buy a car. In addition to the registration and titling fees. 000 2022 New Hampshire state sales tax Exact tax amount may vary for different items The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

This is imposed at the time the tree is cut at 10 the value of the wood. The sales tax applies to transfers of title or possession through retail sales by registered dealers or lessors while doing business. However New Hampshire is one of five states that doesnt have any sales tax whatsoever.

A free copy of Keys to Vehicle Leasing A Consumer Guide can be obtained by writing to the Federal Reserve or downloaded from the Federal Reserve website. So when it comes to registering your vehicle in NH you will not pay any sales tax. Property taxes that vary by town Auto registration fees A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption.

New Hampshire is one of the few states with no statewide sales tax. New Hampshire DMV Registration Fees 18 per thousand for the current model year 15 per thousand for the prior model year. Sales tax varies by state but overall it will add several hundred or even a thousand dollars onto the price of buying a car.

If the sale is made by a motor vehicle or trailer dealer or lessor who is registered the sales tax rate is 625. Nearly every state in the US implements a sales tax on goods including cars. Ad Get New Hampshire Tax Rate By Zip.

New Hampshire also has a timber tax. The business enterprise tax is 55 percent for taxable periods ending on or after December 31 2022. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125.

State of New Hampshire Division of Motor Vehicles. Free Unlimited Searches Try Now. For an explanation of fees please see RSA 261141 for state fees and RSA 261153 for towncity fees.

Business enterprise tax due dates. Are there states with little to no sales tax on new cars. Registration fees are low with averages between 3120 and 5520 Insurance rates are lower than in most states.

They are nonrenewable and you must register the vehicle within this period to get regular plates. That means you only pay the sticker price on a car without any additional taxes. The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states.

While non-residents of New Hampshire can purchase a car there and pay no sales tax at the time they buy it they will owe taxes on the vehicle when they go to register it in their state of residence unless they live in another state with no sales tax. For details please call 603-227-4030 or visit the following. While New Hampshire does not charge vehicle sales tax they still have DMV fees.

If you are legally able to avoid paying sales tax for a car it will save you some money. 000 2022 New Hampshire state sales tax Exact tax amount may vary for different items The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Because registering a vehicle in New Hampshire is a two-part process there are fees due to both the towncity and to the State.

New Hampshire is one of the few states with no statewide sales tax. New Hampshire may not have a car sales tax rate but there are still additional fees to be aware of. The tax is due on gross receipts that exceed 222000 or if the Enterprise Value Tax Base is greater than 111000.

The fee is 10. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax on telecommunications services. No there is no sales tax.

If you live in New Hampshire when you buy a car in Massachusetts you dont have to pay Mass sales tax. I traded a car for another car and now I cant register the car that I got New Hampshire 3 replies Property Taxes and other taxes New Hampshire 23 replies Paying taxes in NH New Hampshire 14 replies Insurance Cost of Living Taxes Car Inspections New Hampshire 19 replies Questionable value for your property taxes New Hampshire 11. 11 - What is the 2022 New Hampshire Sales Tax Rate.

No sales tax No capital gains tax No inheritance or estate taxes New Hampshire does collect. The registration fee decreases for each year old the vehicle is. NH is also one of the few states that doesnt charge a sales tax on vehicle purchases.

In addition to the registration fees there is an 800 plate fee for the first time you order plates. For taxable periods ending before December 31 2016 an 85 tax is assessed on income from conducting business activity within the State of New Hampshire. There are few additional fees and taxes associated with buying a used vehicle.

For example sales tax in California is 725. The Federal Reserve Board has a publication specifically on car leasing. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax.

The only way to avoid this is to register the car in New Hampshire.

Car Shipping Companies New Hampshire Auto Transport Near Me Car Transport New Hampshire Nh

Sedan Vehicles Enterprise Car Sales

Free Car Vehicle Sales Receipt Template Pdf Word Eforms

Free Car Vehicle Sales Receipt Template Pdf Word Eforms

Audi Vehicles Enterprise Car Sales

Vehicle Sales Tax Deduction H R Block

Most And Least Expensive States For Car Ownership Where Does Your State Rank Bestride

5 Unusual Low Mileage Cars For Sale On Autotrader Autotrader

Comparison Between U S And Canada Vehicle Prices Diy Blog

States That Allow Trade In Tax Credit

What Are Dealer Fees Capital One Auto Navigator

What Car Dealer Fees You Must Pay Some That Are Negotiable Pomcar

Free Car Vehicle Sales Receipt Template Pdf Word Eforms

New Grand Wagoneer For Sale In Milford Nh

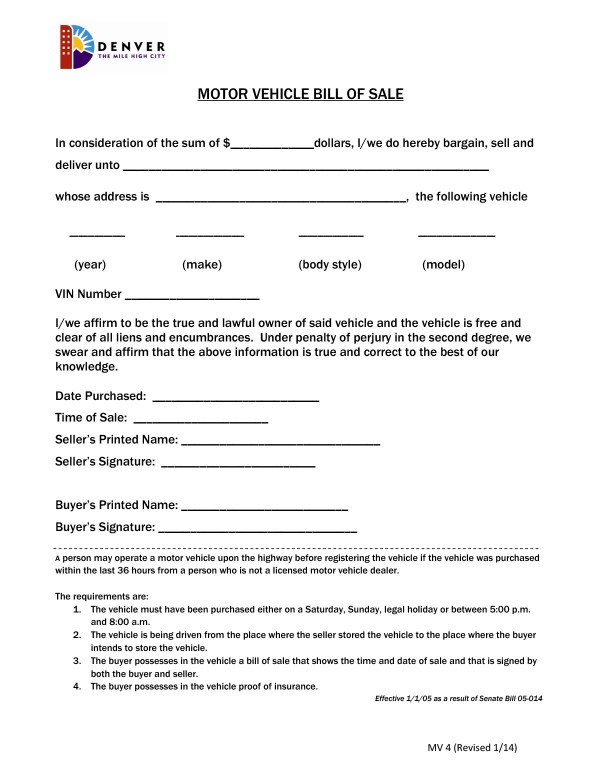

Colorado Bill Of Sale Forms And Registration Requirements 2020